The recent Victorian Court of Appeal judgment in Cant v Mad Brothers Earthmoving Pty Ltd [2020] VSCA 198 clarifies the circumstances in which a payment from a third party may constitute an unfair preference. The decision is important to any creditors with potential exposure to unfair preference claims and for insolvency practitioners seeking to pursue such claims.

Facts

Eliana Constructions and Development Group Pty Ltd (In Liquidation) (Company) owed Mad Brothers Earthmoving Pty Ltd (Creditor) a debt for excavation works. The parties agreed to settle the debt for an amount of $220,000.

To pay the debt, a related entity by way of a common director, Rock Development & Investments Pty Ltd (Third Party), borrowed the funds from a lender. The lender transferred the sum directly to the Creditor to pay the debt under a settlement agreement.

The liquidator of the Company brought a claim against the Creditor seeking to recover the $220,000 payment as an unfair preference pursuant to section 588FA of the Corporations Act 2001 (Cth) (Act).

The liquidator claimed the Third Party was indebted to the Company at the time the payment was made and therefore was a payment by the Company to the Creditor. The Company’s books indicated the opposite was true, and the Third Party was a creditor, not a debtor of the Company.

The liquidator’s claim was successful at trial. The decision was reversed on appeal by the Supreme Court of Victoria. The liquidator appealed to the Court of Appeal.

Court of Appeal Decision

The Court of Appeal reached the following conclusions:

- To be an unfair preference, the payment must be made ‘from the company’ meaning from the company’s own money or money which the company is entitled to.

- It is necessary, in order for a preference to be made ‘from the company’ that the payment has the effect of diminishing the assets of the company available to creditors.

- A payment by a third party which does not have the effect of diminishing the assets of the company available to creditors is not a payment received ‘from the company’ and is therefore not an unfair preference.

The Court held that the payment made by the Third Party to the Creditor was not a payment ‘from the Company’ for the following reasons:

- The liquidator failed to prove that the Third Party was indebted to the Company.

- The payment did not have the effect of diminishing the assets of the Company available to creditors.

A copy of the judgment of the Victorian Court of Appeal is available here.

For consultations, please call us on 1300 757 534 or send us a message.

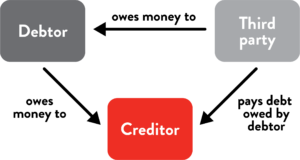

When is a third party payment a preference?

If a payment is made by a third party to a creditor on behalf of a debtor, the key issue is whether the the payment diminished the assets of the debtor company available to creditors.

To illustrate this, see below diagrams.

The above scenario would be an unfair preference because the debt owed by the third party is used to pay the debt owed to the creditor. This has the effect of diminishing the assets of the company.

The above scenario would not be an unfair preference because debt owed by the debtor to the creditor is merely replaced by an equivalent debt owed to the third party. The asset position of the debtor is unchanged.

Take away points

- The decision identifies a possible loophole in the unfair preference regime. In certain circumstances, receiving payment from a third party can protect a creditor from an attempt by a liquidator to claw back the funds.

- A payment by a third party will only be an unfair preference if the payment diminished the assets of the company available to creditors.

- Creditors should consider whether payment of a debt owed by a distressed company can be structured in a way to avoid falling foul of the unfair preference regime.

- A settlement agreement between a creditor, debtor and third party may, with careful wording allow for payments made by a third party to be out of reach of a liquidator.

- Careful consideration should be given to any arrangements between a third party and a debtor. If the third party owes a debt to the debtor company, the payment will likely be considered to be ‘from the company’ and a creative settlement agreement will not have the desired effect.

Other practical tips

The temporary COVID-19 insolvency provisions will continue until at least 31 December 2020. Subject to the impact of the Small Business Insolvency Reforms, we may see a rise in insolvencies and unfair preference claims from January 2021.

In addition to getting paid by a third party, there are a number of strategies that can be employed by creditors to reduce the risk of receiving an unfair preference claim.

- Take security. Preference claims can only be brought for payments made in respect of an unsecured debt. It is best practice for credit terms to provide for security in the form of a purchase money security interest (PMSI) relating to goods supplied on credit or a registered mortgage.

- Utilise the running account. If a creditor continues to supply goods during the six month period prior the start of the liquidation, the liquidator’s claim will be limited to the “net effect” of the transactions. A potential preference claim may be completely extinguished if the value of the goods supplied exceeds the sum of the payments made during this period.

- Be careful with what is put in writing when chasing debts as it could hurt a creditor’s prospects of establishing the good faith defence under section 588FG of the Act. A liquidator will use demands for payment as evidence that a creditor had reasonable grounds to suspect the company was insolvent.

- Where possible, obtain payment in advance or cash on delivery. If a creditor/debtor relationship does not exist, the payment will fall outside of the unfair preference regime.

- Engage a solicitor to undertake a review of your credit application and security documents.