Unfair Contract Terms

Everything you need to know

and next steps

Everything you need to know and next steps.

This page provides all the information you need to know about the changes to the Unfair Contract Terms regime.

In what we regard as onerous and punitive reforms, the expanded unfair contract terms law (UCT) that came into effect on 9 November have and will continue to affect thousands of businesses’ standard form contracts.

Now is the time to review your terms and conditions of trade and any other standard form contracts on which you trade (e.g. purchase order conditions, consignment agreements, credit documentation etc).

Our Principal, Anna Taylor, explains the changes to the Unfair Contract Terms and what you need to do to get your business ready.

Resources and Insights

The sweeping reforms of the unfair contract terms regime mark a significant shift in the legal landscape for standard form small business contracts and consumer contracts. As the changes came into effect on 9 November, 2023, it’s important to stay informed.

Our expert team has created a suite of resources and insights to help guide you through this transition and into the future.

Quarterly Trends Report: SBRs, Trade Credit & Family Enterprise Succession

Protecting Minority Shareholder Rights: A $2 Million Victory

When majority shareholders abuse their power, minority shareholders can feel powerless, but the law is on their side. Our recent case shows the difference a strategic approach can make, achieving

Unfair Contract Terms Regime: Current Insights and Strategies

The reverberations of Australia's updated unfair contract terms regime, implemented on 9 November 2023, continue to be felt across the business community.

Since implementation, businesses and credit professionals have been

Unfair Contract Terms Regime Situation Report

The reverberations of Australia's updated unfair contract terms regime, implemented on 9 November 2023, continue to be felt across the business community.

Since implementation, businesses and credit professionals have been

Fair Go Mate: The Rise in Defences using Unfair Contract Terms

The increased use of the Unfair Contract Terms Regime as a defence in legal claims during debt recovery is not a coincidence. It's a result of economic growth softening, the

Successful Defence to Unfair Contract Terms Case

Tailored and well-structured standard form contracts are the bedrock of robust commercial relationships, for both business and consumer relationships. They provide clarity for all parties and ensure businesses are compliant

Unfair Contracts: Frequently Asked Questions

As the changes to the Unfair Contract Terms Regime have now come into effect, many of our clients have been seeking clarification on what this means for their businesses.

With

Corporate Counsel’s Guide to The Unfair Contracts Regime Changes

From 9 November 2023, the amended Unfair Contract Terms Regime is in effect.

It is crucial for Australian businesses and their legal teams to be fully aware of the

Is your Credit Documentation and Terms of Trade Unfair?

![[Webinar] Unfair Contract Term Changes are Imminent [hosted by BICB]](https://resultslegal.com.au/wp-content/uploads/2023/08/Webinar-The-New-Unfair-Contract-Terms.jpg)

[Webinar] Unfair Contract Term Changes are Imminent [hosted by BICB]

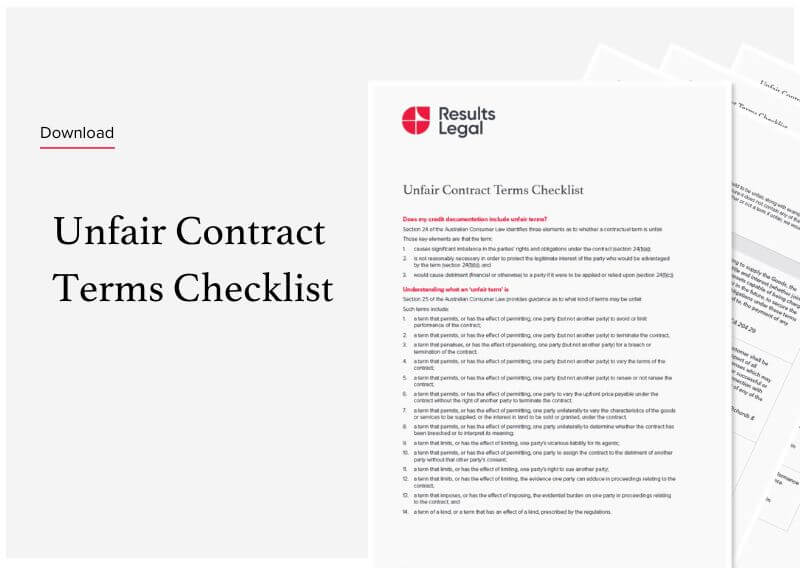

Unfair Contract Terms Checklist

Unfair Contract Terms Regime – Key Questions

In what we regard as onerous and punitive reforms, the new unfair contract terms law (UCT) coming into effect on 9 November this year will affect thousands of businesses’ standard

![[Webinar] The New Unfair Contracts Terms: What it means for your business](https://resultslegal.com.au/wp-content/uploads/2023/05/Webinar_The-New-Unfair-Contract-Terms.jpg)

[Webinar] The New Unfair Contracts Terms: What it means for your business

Onerous and punishing – the new unfair contract terms regime will affect thousands of businesses standard form of contracts.

Is your business prepared for the changes?

Join us at 12pm

Frequently Asked Questions

No cost review of your credit documentation

We are offering a no cost review of your terms of trade and credit documentation. To take advantage of this offer, or to speak to us generally about the expanded Unfair Contract Term Regime, please contact the Results Legal team on 1300 757 534 or via the contact form below.